It takes the stress out of managing your finances by putting it all in one streamlined (and largely automated) app. You’ll no longer need to spend late nights jumping between multiple platforms to get your finances in order.

When it comes to running a small business, Michael Nuciforo has stood on both sides of the fence. He worked in banking for 10 years, servicing small business owners, before he got involved in the startup world and found that banks weren’t useful companions for managing your finances.

“Running my own business made me see the challenges that small business owners had been complaining about,” he says. “I was staying up doing spreadsheets all night, financial planning, sending invoices, paying bills, punching numbers – the banks were still neglecting this area and I realised there had to be a solution there.”

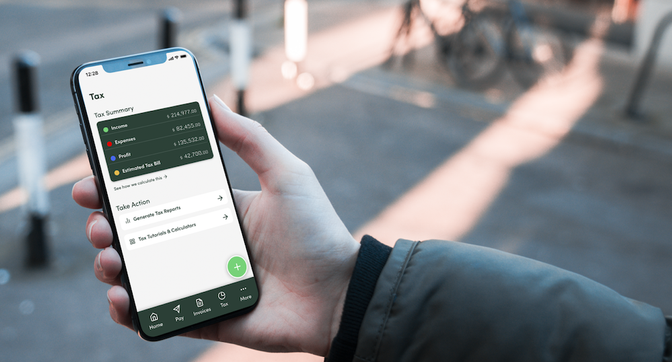

That solution is Thrive, Nuciforo’s forthcoming, all-in-one app for managing your business finances. It’s designed to help you manage payroll, send invoices, fill out your tax return, collect and send payments, budget and forecast in one versatile app, instead of on multiple platforms such as Xero, MYOB, internet and mobile banking.

“It’s like having an accountant or a personal financial assistant in your pocket,” Nuciforo says. “So far we’ve seen it really benefit small hospitality and retail, sole traders and tradespeople and freelancers in the design and media fields.”

Creating an account is free, and services range from $5 to $15 per month. You can pick and choose which services you need and only pay for the ones you use. If you need invoicing and tax help but not payroll, for example, you can leave that off (and add it at a later date if you change your mind). Thrive is also a tax deductible expense, as it comes under the cost of managing your tax affairs.

Thrive users can also scan and save receipts for tax time, create custom invoice templates and integrate the app with Xero and other accounting packages. You can see a full list of features here.

Nuciforo says that streamlining and automating financial services for businesses (and making it affordable) will benefit both business owners and consumers.

“We want to give back lost time. If you can do that at a macro level, then the grand ambition is to have a thriving small to medium business sector in Australia,” he says. “If you’re a consumer and the business owner has an extra five hours to invest in the business rather than finance, you’re going to get a better experience, a better coffee or a better product.”

Thrive launches to the public in May 2021, but you can sign up for free here for early access.

We hope you like the products we recommend on Scout. Our editors select each one independently. Scout may receive an affiliate commission when you follow some links.